The Only Guide for Nj Cash Buyers

The Only Guide for Nj Cash Buyers

Blog Article

The 6-Minute Rule for Nj Cash Buyers

Table of ContentsFascination About Nj Cash BuyersOur Nj Cash Buyers IdeasGet This Report about Nj Cash BuyersThe Nj Cash Buyers Diaries

The majority of states give customers a specific degree of security from creditors concerning their home. Some states, such as Florida, completely excluded the home from the reach of particular lenders. Various other states set restrictions ranging from as low as $5,000 to approximately $550,000. "That means, regardless of the worth of your home, lenders can not compel its sale to satisfy their claims," claims Semrad.You can still enter into foreclosure with a tax obligation lien. For instance, if you stop working to pay your home, state, or federal taxes, you could lose your home with a tax obligation lien. Buying a house is a lot simpler with money. You do not need to wait on an evaluation, assessment, or underwriting.

(https://www.gaiaonline.com/profiles/njcashbuyers1/46903197/)I know that many sellers are much more likely to accept an offer of money, but the seller will certainly get the cash no matter of whether it is financed or all-cash.

Nj Cash Buyers Can Be Fun For Everyone

Today, concerning 30% of US buyers pay cash for their residential or commercial properties. There might be some excellent factors not to pay money.

You might have certifications for an exceptional mortgage. According to a recent study by Money publication, Generation X and millennials are taken into consideration to be populaces with the most possible for growth as customers. Tackling a bit of debt, particularly for tax functions excellent terms could be a better option for your financial resources on the whole.

Perhaps spending in the securities market, shared funds or a personal service could be a much better alternative for you in the future. By buying a property with cash money, you take the chance of diminishing your book funds, leaving you prone to unforeseen maintenance expenses. Possessing a property requires continuous expenses, and without a mortgage padding, unexpected repairs or renovations can stress your finances and hinder your capacity to keep the home's problem.

The Definitive Guide to Nj Cash Buyers

Home prices fluctuate with the economy so unless you're intending on hanging onto your house for 10 to three decades, you may be much better off investing that cash in other places. Purchasing a residential or commercial property with cash can expedite the acquiring process considerably. Without the need for a home mortgage approval and associated documentation, the deal can shut much faster, supplying an one-upmanship in competitive realty markets where vendors may choose cash buyers.

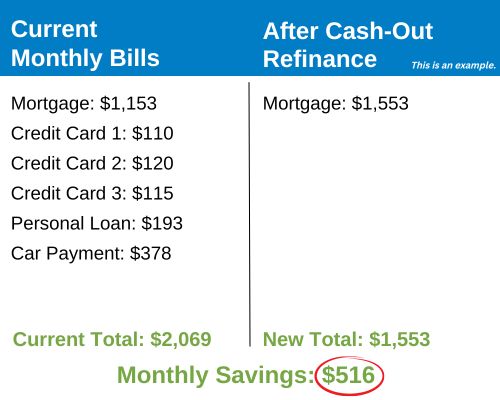

This can lead to substantial expense financial savings over the long term, as you will not be paying passion on the finance quantity. Cash purchasers frequently have more powerful settlement power when managing sellers. A money deal is more appealing to vendors given that it reduces the risk of an offer dropping via due to mortgage-related problems.

Bear in mind, there is no one-size-fits-all remedy; it's necessary to customize your choice based on your private conditions and long-lasting ambitions. Ready to begin taking a look at homes? Provide me a phone call anytime.

Whether you're selling off properties for a financial investment home or are vigilantly saving to buy your dream home, purchasing a home in all money can substantially boost your acquiring power. It's a strategic action that enhances your placement as a customer and improves your flexibility in the realty market. It can put you in a financially vulnerable place.

Nj Cash Buyers Fundamentals Explained

Reducing rate of interest is just one of the most common factors to purchase a home in cash. Throughout a 30-year home loan, you could pay 10s of thousands or perhaps thousands of countless dollars in overall interest. Additionally, your acquiring power raises without any financing contingencies, you can discover a wider option of homes.

The largest danger of paying money for a home is that it can make your financial resources volatile. Tying up your liquid assets in a residential or commercial property can minimize economic adaptability and make it much more tough to cover unexpected expenditures. Additionally, binding your money implies missing out on out on high-earning financial investment chances that might yield greater returns in other places.

Report this page